The impact of Inflation on Luxury travel in Europe

In the intricate tapestry of Europe’s hospitality landscape, a distinct contrast emerges between the preferences and demands of international and domestic travelers. This article delves into the factors shaping this divergence, examining the dynamic trends that influence hotel occupancy, customer expectations, and the economic implications for the thriving European tourism sector. Join us on a journey through the nuances of accommodating diverse guest profiles and uncovering the evolving patterns that define the hospitality industry on the continent.

Let’s explore the significant shifts in travel patterns for both domestic and international travel to Europe, using Adara’s travel intent data.

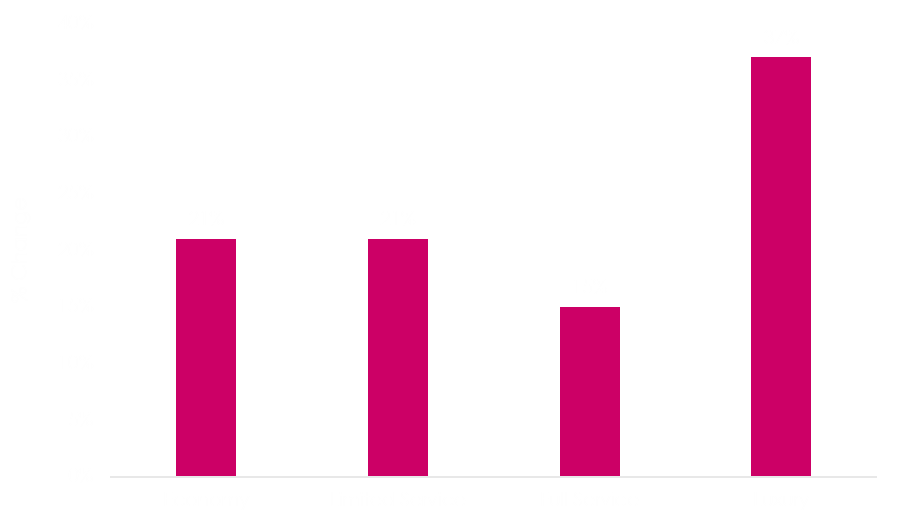

Domestic Leisure Travelers Prefer Luxury

European travelers prefer spending money on luxury hotel rooms in their home countries. Unlike international travelers who have cut down on staying in luxury hotel rooms, domestic travelers in Europe are choosing to stay in luxury hotels. Bookings of luxury rooms are 37% higher y-o-y for domestic leisure travelers in Europe.

Y-O-Y Change in Hotel Bookings by Class in Europe for Domestic Leisure Travelers

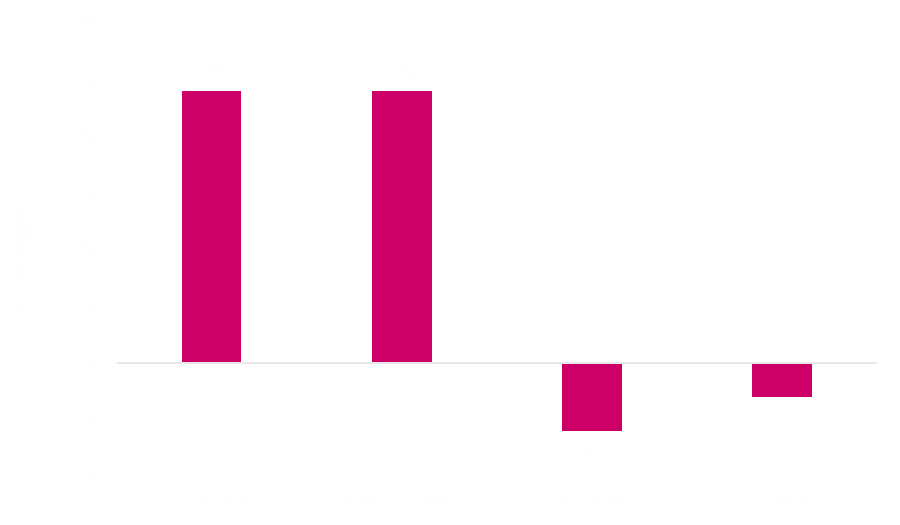

International Travelers Feel the Pressure of Inflation

A strengthening currency and surging inflation in Europe have been major factors impacting international leisure travel in Europe. As inflationary pressures affect consumer spending power, there seems to be a trend towards more budget-conscious choices in accommodation. This is reflected in the decreased reservations for full-service and luxury hotel rooms, as travelers may be adjusting their preferences to align with budget constraints imposed by rising prices.

Bookings for economy-class and limited-service hotel rooms in Europe have notably increased when compared to the previous year, while there has been a slight decline in bookings for full-service and luxury hotel rooms.

International Travelers Prefer Economy and Limited-Service Hotels

Economy class and limited-service hotel rooms are booked 24% higher y-o-y in Europe compared to 2022. Full-service and luxury hotel rooms are booked marginally lower at 6% and 3%.

With the Euro gaining strength, international travelers find budget-friendly accommodation options more appealing, leading to increased demand for economy and limited-service hotel rooms across Europe.

The winter season sees a rise in demand for cost-effective lodging, as the robust Euro makes European destinations more expensive, prompting a notable uptick in bookings for economy and limited-service hotel rooms from travelers around the globe.

Y-O-Y Change in Hotel Bookings by Class in Europe

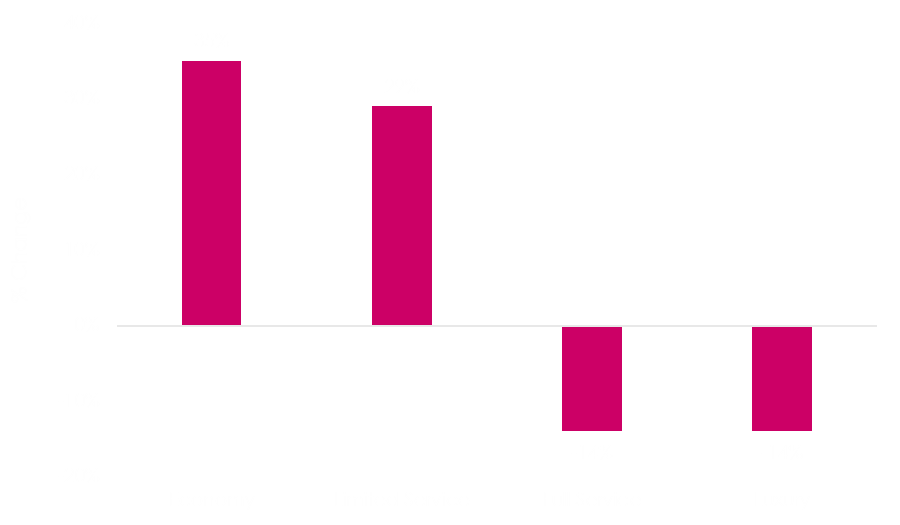

Cut on International Business Travel Budgets

A closer look reveals that it’s international business travelers who have reduced their budgets for accommodation in Europe. Their bookings for full-service and luxury hotel rooms have decreased, but there’s been a significant rise in bookings for economy-class and limited-service rooms.

Bookings of full-service and luxury hotel rooms by international business travelers are 14% lower y-o-y compared to 2022. However, bookings of economy-class rooms and limited-service rooms are 35% and 29% higher y-o-y.

Y-O-Y Change in Hotel Bookings by Class in Europe for International Business Travelers

In the coming months, the dual effects of inflation and currency exchange rates are poised to reshape the landscape of travel in Europe. Travel businesses can strategically position themselves by staying ahead of emerging travel trends, and reaching their target audience at the right time. The World on Holiday Travel Insights Center can assist in keeping abreast of industry movements.

About World on Holiday

World on Holiday is an attempt to create a real-time travel-insights center to tell you simply one thing – what travelers are interested in. The insights sourced from hundreds of first-party data sources are based on actual consumer activity and are relevant for anyone who needs a quick way to understand the key macro-trends in any region.

For regular updates on who, why, and how the world is traveling, subscribe to the ‘World on Holiday’ Insights Center.

About RateGain

RateGain is a global provider of SaaS solutions for travel and hospitality that works with 2800+ customers—including the Top 23 of 30 Hotel Chains, the Top 25 of 30 Online Travel Agents, and all the top car rentals including 8 Global Fortune500 companies—and 700+ partners in 100+ countries helping them accelerate revenue generation through acquisition, retention, and wallet share expansion.